When you plan to buy a car, one of the biggest questions that comes to mind is whether you should go for a car loan or a personal loan. Both loans help you manage the cost of buying a vehicle, but they work in slightly different ways. Understanding these differences can make your decision easier and also help you choose a loan that suits your financial situation and repayment comfort.

In this blog, we will talk about Car Loan vs Personal Loan, how both loans work, their interest rates, repayment structure, eligibility, and which option is usually better for car buyers. The goal is to explain everything in simple and easy English so that you can read and understand things comfortably.

What is a Personal Loan and How Does it Work?

A personal loan is a type of loan where the bank or lender gives you a lump-sum amount, and you can use that money for almost any purpose. You can use it to buy a car, pay for a wedding, renovate your home, or even manage emergency expenses. This flexibility is one reason many people consider Personal Loan for Buying a Car.

Most personal loans are unsecured, which means you do not need to pledge any asset or collateral. Since there is no security, the lender takes a higher risk, and because of that, the interest rate on personal loans is usually higher compared to car loans. If a personal loan is secured against an asset, then the lender has the right to take possession of that asset if the borrower fails to repay the loan.

The approval of a personal loan depends a lot on your credit score, repayment history, and income profile. A good credit score increases your chances of getting a higher loan amount and a better interest rate. Personal loans also come with fixed repayment terms, such as 12, 24, or 36 months. Shorter tenures usually mean higher monthly instalments but lower total interest over time, while longer tenures reduce the EMI but increase the overall interest.

Understanding Car Loan and Why It Is Preferred for Vehicle Purchase

A car loan, also known as an auto loan, is a type of secured loan designed only for purchasing vehicles. In this case, the car itself works as collateral. This means the lender has partial ownership of the vehicle until the entire loan amount is repaid.

Because the lender has the car as security, the risk is lower compared to unsecured loans. Due to this lower risk, Auto Loan vs Personal Loan interest rates generally favors auto loans, as they usually come with lower interest rates. The EMI remains fixed for the entire tenure, which makes planning your monthly budget easier.

The repayment period for car loans can range from one year to as long as seven years. Many people choose longer tenures to keep EMIs affordable, although this increases the total interest paid over time. Even individuals with average or slightly lower credit scores may still get approved for a car loan because the vehicle works as collateral.

However, one important thing to remember is that the car officially becomes fully yours only after the last EMI is paid. Until then, the lender has a lien on the vehicle.

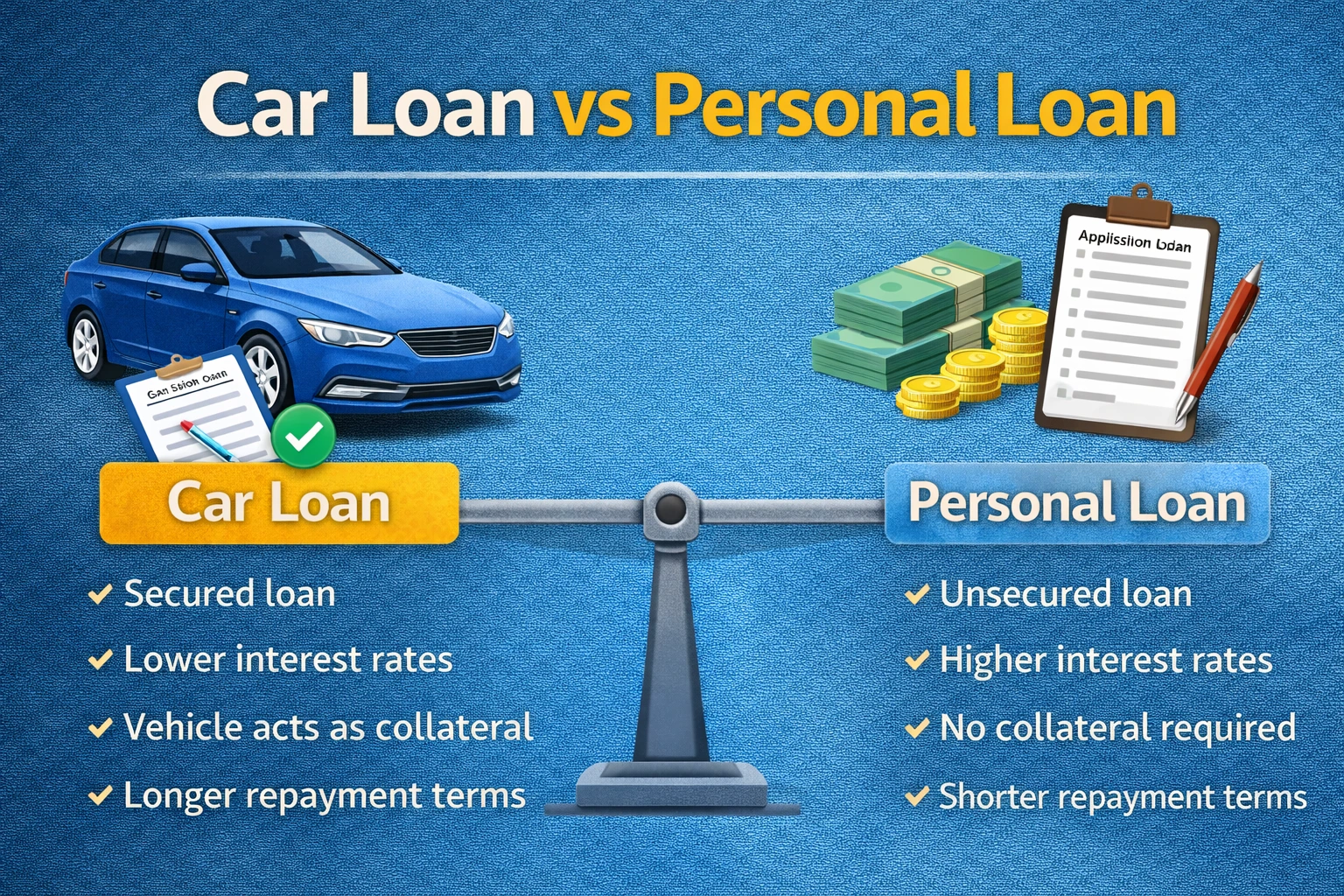

Key Differences Between Car Loan and Personal Loan

When we compare Car Loan vs Personal Loan, the first difference is that a car loan is a secured loan and a personal loan is usually unsecured. In a car loan, the vehicle acts as collateral, while in a personal loan there is no collateral involved. Because of this, the interest rate on a car loan is normally lower, while personal loan interest rates are slightly higher.

Another difference is usage. A car loan can only be used for buying a new or used car. On the other hand, a personal loan can be used for multiple purposes, including buying a car, accessories, insurance expenses, or even other personal needs.

In terms of loan amount, car loans often provide higher funding, especially when the car price is high. Personal loans usually come with a moderate loan limit depending on your credit profile. Processing of a personal loan is generally faster, while car loan approval may take slightly more time because of documentation and verification.

Repayment tenure also varies. Car loans normally offer longer repayment terms, whereas personal loans come with relatively shorter durations.

Which is Better — Car Loan or Personal Loan?

The answer to Which is better, a car loan or a personal loan? depends on your personal financial needs and priorities.

If your main objective is to get lower interest rates, manageable EMIs, and higher financing for the vehicle, then a car loan is often considered the better option. It is structured specifically for vehicle purchases, comes with predictable repayment, and is easier to manage in the long term.

However, some people prefer a personal loan for car purchase because it does not involve hypothecation of the vehicle. You get full ownership from day one, and there is no lender lien on the car. A personal loan is also useful when you are buying a second-hand car or when you want more flexibility in managing funds.

Still, the higher interest rate makes personal loans slightly costlier compared to car loans, especially for long-term repayment.

Things to Consider Before Choosing Car Loan vs Personal Loan

Before deciding between Car Loan vs Personal Loan, it is important to consider a few practical factors. The first is your budget and EMI affordability. Make sure your monthly instalments do not put unnecessary pressure on your finances. Comparing interest rates and processing charges also helps you understand the actual cost of the loan.

Check how much loan amount you really need. Car loans usually provide higher financing, but personal loans give you more spending freedom. Ownership is another point to think about, because car loans involve temporary lender control until repayment is complete, while personal loans give instant full ownership.

Your credit score also plays an important role. A strong credit profile can improve your chances of getting better loan terms in both cases.

Final Thought on Car Loan vs Personal Loan

Choosing between a car loan and a personal loan is more about understanding your priorities than finding a single right answer. If you want lower interest rates, structured repayment, and higher loan eligibility, then a car loan generally works better for most car buyers. But if you prefer flexibility, quicker approval, or do not want your car tied to a lender, then a personal loan can also be a suitable choice.

Take your time, assess your budget, think about how long you want to repay the loan, and then pick the option that feels more comfortable for your financial situation.